“Viewpoint” host Eliot Spitzer, Matt Taibbi, Rolling Stone contributing editor, and Dennis Kelleher, president and CEO of Better Markets, analyze the Libor interest rate–rigging scandal engulfing the banking industry.

Barclays CEO Bob Diamond recently resigned after the bank was fined $453 million for its part in the scandal, which involved manipulating the London Interbank Offered Rate (Libor), a key global benchmark for interest rates, by essentially “faking their credit scores,” according to Taibbi. And as Taibbi explains, Barclays couldn’t have acted alone.

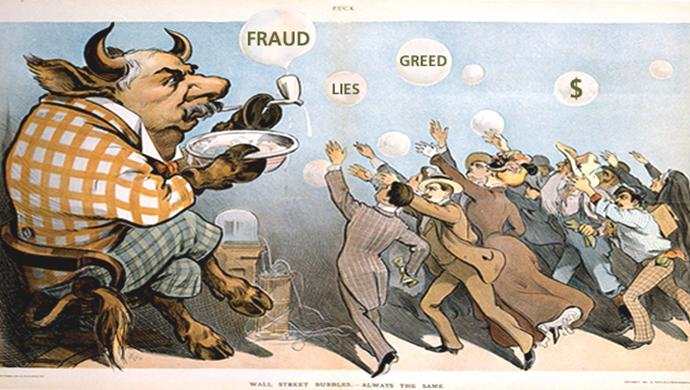

“It can’t just be Barclays and the Royal Bank of Scotland. In fact, it can’t even be four banks or even five banks,” he says. “Really, in the end it’s probably going to come out that it’s going to be all of them … involved in this. And that’s what’s critical for people to understand: that this is a cartel-style corruption.”

Kelleher argues that the Libor scandal is proof that the financial industry “is corrupt and rotten to its core.” “The same executives [using] the same business model that crashed the entire financial system in ’08 are still running these banks,” he says.

~

And the swindle and ponzi schemes to the American people will continue…..