Merscorp Sued in Dallas With Bank of America Over Mortgage-Tracking System

Mortgage Electronic Registration Systems Inc., along with Bank of America Corp. (BAC), was sued by Dallas County District Attorney Craig Watkins over claims its mortgage-tracking system violates Texas law.

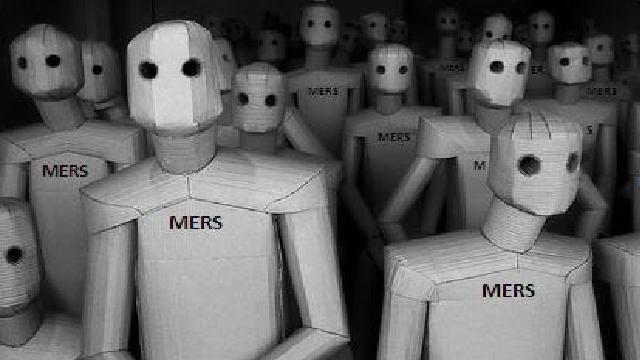

Merscorp Inc.’s MERS, which runs an electronic registry of mortgages, cheated Dallas County out of “tens of millions in uncollected filing fees,” Watkins said in a statement. MERS tracks servicing rights and ownership interests in mortgage loans on its registry, allowing banks to buy and sell loans without recording transfers with counties.

Watkins, in a complaint filed yesterday in state court in Dallas, claims MERS was established by banks including Bank of America to avoid paying filing fees, as well as to ease transfers of mortgages. The county asked the court to hold Bank of America liable as a shareholder of MERS and said the bank “knew or should have known” that the system would cause improper filing.

“Texas public policy favors a reliable functioning public recordation system to avoid destructive breaks in title, confusion as to true identity of the holder of a note, fraudulent foreclosures and uncertainty as to title when a home is sold,” Watkins, said in the 48-page complaint. MERS “has all but collapsed this system throughout the U.S,” he said.

Read the rest here…

Full complaint below…

~

4closureFraud.org

~

Listening to these banksters, with their outrageous claims, make me ask…….what planet am I on……or what planet they are on!

People should know, when they enter the loan mod trap, they have entered into the TWILIGHT ZONE……..