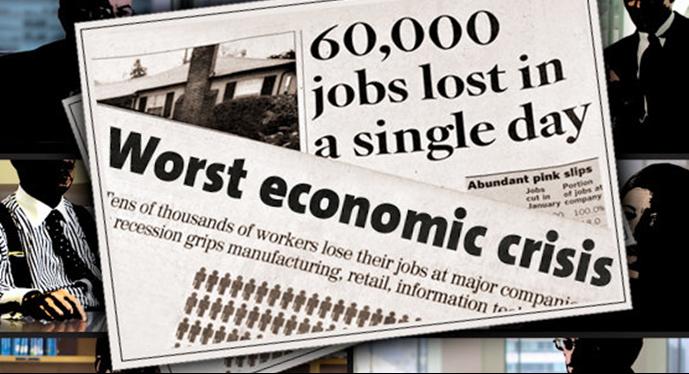

Welcome to Capital Account. It’s been roughly four years since the 2008 financial crisis, and it doesn’t feel like a whole lot has changed on Wall Street. Too Big to Fail Banks are bigger, 650 trillion dollars of over the counter derivatives are still out there, and financial scandals abound. Bloomberg reports Wall Street may face a formidable foe in the Libor scandal if investors and firms sue. That foe is Wall Street itself. And the Financial Times also reports regulators are narrowing in on at least four of Europe’s biggest banks in the rate rigging probe: HSBC, Deutsche Bank, Credit Agricole and Societe General. But will Libor mark a turning point in authorities’ serious pursuit and punishment of Wall Street crime? Lauren interviews director of “Inside Job,” Charles Ferguson about this, and what has or has not changed since 2008’s epic financial crisis.

Also, why haven’t there been convictions of senior level executives on Wall Street for crimes related to the financial crisis in the several years since? The director and producer of the Oscar-winning documentary “Inside Job” and author of the new book “Predator Nation,” Charles Ferguson discusses this with us and taking stock of the financial landscape and where we are four years later. We also examine the axis of finance, government and academia, and ask Charles Ferguson for his take on where this nexus stands today.

And in today’s Loose Change, Lauren and Demetri cover the financial story that triggered our gag reflex: Wall Street clients shelling out for consultants to help their daughters get into the best sororities.

~

And the swindle, the scams and the frauds continue….