Foreclosure Accord Said to Ensure Same Terms for All 50 States

Feb. 4 (Bloomberg) — Lenders including Bank of America Corp. and JPMorgan Chase & Co. and state attorneys general agreed to ensure that states signing a nationwide accord on foreclosures will be entitled to improved terms won later by states that opt out, two people familiar with the matter said.

California Attorney General Kamala Harris is one of the highest profile attorneys general to publicly balk at the settlement, saying she won’t sign a deal that blocks investigations into mortgage loans.

New York Attorney General Eric Schneiderman, who last week declined to say whether he would sign the deal, yesterday sued Bank of America, based in Charlotte, North Carolina, New York- based JPMorgan and Wells Fargo & Co. in state court in Brooklyn over the use of a national mortgage database that the state claims led to improper foreclosures.

The agreement to grant so-called most-favored nation status comes in the endgame of a probe that began in 2010 following claims of widespread foreclosure wrongdoing by mortgage servicers. States have until Feb. 6 to accept the agreement with the five largest servicers, which also include San Francisco- based Wells Fargo, New York-based Citigroup Inc. and Detroit- based Ally Financial Inc. The deal, said to be worth as much as $25 billion, will settle allegations the banks used faulty or forged documents to seize homes from borrowers.

California’s Share

Without California, the value of the deal may sink to $17 billion, said one of the people. Both declined to be identified because the negotiations aren’t public.

The most-favored nation provision would only kick in under certain thresholds, said a third person familiar with the matter who also didn’t want to be named because the talks aren’t public.

Rest here…

~

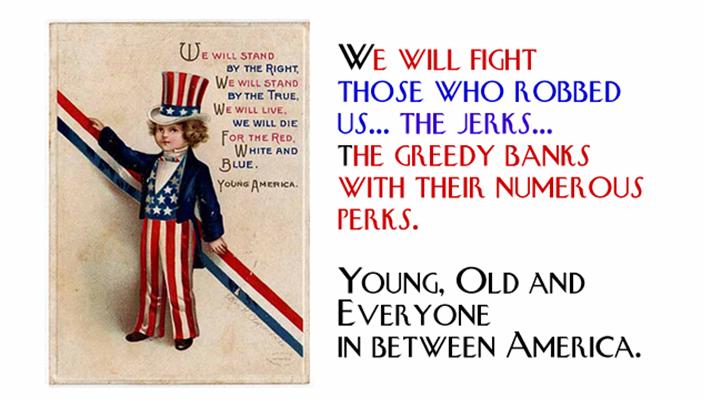

No State AG can void a lawsuit you have toward any institution that has wronged you.

This is still America and we still have the 4th amendment!

Way to go Ron!!

In Washington State the attorney General works for the State, not the citizens except for thre consumer protection office, which he has vacated, But he does not speak for me or my personal suit against, MortgeIT, IndyMac. HSBC> MERS ETC. ETC. So while ha may make agreement for the State He does not make agreement for me.

Notice how nobody wants to be named?If this is such a good deal and it’s going to do so much for everyone then why wouldn’t you want to be named?Just more addelpated B.S.