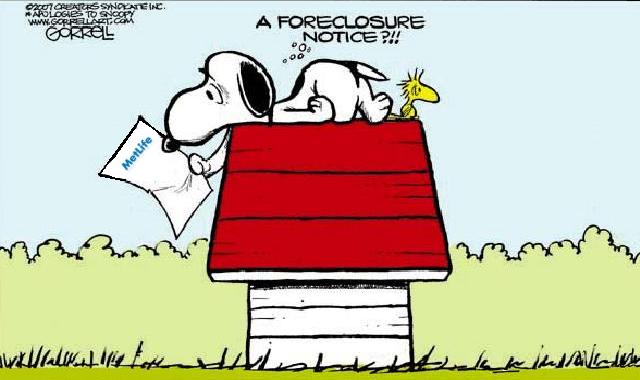

Federal Reserve Board announces issuance of monetary sanctions against MetLife

For immediate release

The Federal Reserve Board on Tuesday announced the issuance of monetary sanctions totaling $3.2 million against MetLife, Inc. for failure to adequately oversee its subsidiary bank’s mortgage loan servicing and foreclosure processing operations. The oversight deficiencies represented unsafe and unsound practices at MetLife and corrective measures were required by a formal enforcement action issued against the company on April 13, 2011.

The $3.2 million assessed against MetLife takes into account the maximum amount prescribed for unsafe and unsound practices under the applicable statutory limits, the comparative severity of MetLife’s misconduct, and the comparative size of MetLife’s foreclosure activities.

The April 2011 action against MetLife was among 14 corrective actions issued against large mortgage servicers or their parent holding companies for unsafe and unsound processes and practices in residential mortgage loans servicing and foreclosure processing. Those deficiencies were identified by examiners during reviews conducted from November 2010 to January 2011.

The Board’s assessment order against MetLife contains similar terms to those in the assessment orders issued by the Board in February 2012 imposing monetary sanctions against five other mortgage servicing organizations. The Board’s assessments against these five organizations were issued in conjunction with a comprehensive settlement agreement between the organizations and the state attorneys general and the U.S. Department of Justice requiring the organizations to provide payments and designated types of monetary assistance and remediation to residential mortgage borrowers. Although MetLife was not a party to the settlement in February, the Board’s monetary sanctions against MetLife contemplate the possibility of a similar settlement under which MetLife agrees to provide borrower assistance or remediation.

In particular, if by June 30, 2013, MetLife enters into a settlement with the attorneys general and Justice Department similar to the February agreement, MetLife must pay the Board the amount not expended by MetLife within two years of its agreement for borrower assistance or remediation in compliance with the settlement agreement. If there is no settlement agreement by June 30, 2013, MetLife will be required to pay to the Board the portion of the $3.2 million that it has not expended by August 6, 2014, on funding to nonprofit organizations for counseling to borrowers who are facing default or foreclosure, or in connection with the independent foreclosure reviews required by the April 2011 enforcement actions.

The Federal Reserve will closely monitor expenditures on borrower assistance and remediation and the counseling program and compliance by MetLife with the requirements of the monetary sanctions issued by the Board. Any money paid by MetLife to the Board will be remitted to the U.S. Treasury.

The Board is taking action against MetLife at this time in light of MetLife’s publicly announced decision to sell its subsidiary bank’s deposit-taking operations. Because that sale is subject to formal approval by regulators other than the Board and would result in MetLife no longer being a bank holding company, the Board believes it is appropriate to act at this time.

The Board continues to believe that monetary sanctions in the remaining cases are appropriate and plans to announce monetary penalties against those organizations.

SOURCE: http://www.federalreserve.gov

Assessment order below…

~

4closureFraud.org

~

“unsound foreclosures”????? they are all unsound. inducing people to default, predatory loans made to fail, robo signing and robo stamping. and they call us home owners deadbeats. we need to come up with a word to call these banks. i thik its called scum bags!!!

No money to the homeowners????? Just where is all this money and fines going???????????