CUOMO ADMINISTRATION SETTLES WITH COUNTRY’S LARGEST FORCE-PLACED INSURER, LEADING NATIONWIDE REFORM EFFORT AND SAVING HOMEOWNERS, TAXPAYERS, AND INVESTORS MILLIONS OF DOLLARS

Cuomo Administration Settlement with Assurant Includes Restitution for Homeowners, a $14 Million Penalty, and Industry-leading Reforms

Cuomo Administration Says Other Force-placed Insurers, Including QBE, Need to “Step Up to the Plate Now” and Put in Place These Reforms

NEW YORK, NY – Governor Andrew M. Cuomo today announced that a New York State Department of Financial Services (DFS) investigation has produced a major settlement with the country’s largest “force-placed” insurer, Assurant, Inc., which will help lead a nationwide reform effort for this industry. The settlement includes restitution for homeowners who were harmed, a $14 million penalty paid to the State of New York, and industry-leading reforms that will save homeowners, taxpayers, and investors millions of dollars going forward through lower rates.

“The force placed insurance industry has for too long been plagued by an intricate web of relationships between insurers and banks that pushed distressed families over the foreclosure cliff,” said Governor Andrew M. Cuomo. “Today’s agreement starts us on the road to reform, which will clean up this industry and truly protect working people.”

Benjamin M. Lawsky, Superintendent of Financial Services said: “Our investigation found that insurers and banks built a network of troubling relationships and payoffs that helped drive premiums sky high. Those improper practices created significant conflicts of interest and saddled homeowners, taxpayers, and investors with millions of dollars in unfair and unnecessary costs. This settlement includes major reforms that will put a stop to those practices at Assurant, provide restitution to homeowners who were harmed, and save millions of dollars for homeowners, taxpayers, and investors going forward through lower rates.”

The Findings of DFS’s Investigation of Assurant

In October 2011, DFS launched an investigation into the force-placed insurance industry, including Assurant and its subsidiaries. Force-placed insurance is insurance taken out by a bank, lender, or mortgage servicer when a borrower does not maintain the insurance required by the terms of the mortgage. This can occur if the homeowner allows their policy to lapse (often due to financial hardship), if the bank or mortgage servicer determines that the borrower does not have a sufficient amount of coverage, or if the homeowner is force-placed erroneously.

The DFS investigation revealed that the premiums charged to homeowners for force-placed insurance can be two to ten times higher than premiums for voluntary insurance — despite the fact that force-placed insurance provides far less protection for homeowners than voluntary insurance.

Indeed, even though banks and servicers are the ones who choose which force-placed insurance policy to purchase, the high premiums are ultimately charged to homeowners, and, in the event of foreclosure, the costs are passed onto investors. And when the mortgage is owned or backed by a government-sponsored enterprise, such as Fannie Mae or Freddie Mac, those costs are ultimately borne by taxpayers.

DFS’s investigation found that Assurant competed for business from the banks and mortgage servicers through what is known as “reverse competition.” That is, rather than competing by offering lower prices, the insurers competed by offering what is effectively a share in the profits. This profit sharing pushed up the price of force-placed insurance by creating incentives for banks and mortgage servicers to buy force-placed insurance with high premiums. That’s because the higher the premiums, the more that the insurers paid to the banks. This was done by:

- Paying commissions to insurance agents and brokers affiliated with the banks even though the agents and brokers did not perform the customary tasks that would justify a commission.

- Paying banks’ “expenses” related to force-placed insurance. These expenses were typically a percentage of premium and were paid to banks that did not have agents or brokers that would collect a premium.

- Paying lump sum amounts, such as one bank’s $1 million termination fee for switching its business to Assurant from another insurer.

- Allowing a reinsurance company owned by a bank to take as much as 75 percent of the premium and therefore 75 percent of the profit. A reinsurance company provides insurance to insurance companies by sharing risk. But since there was little risk in force-placed insurance relative to the high premiums, this was effectively a way to transfer profits. Thus, the bank put itself on both sides of the transaction, paying an inflated premium that hurt the homeowner and then reaping 75 percent of those gains back from Assurant through a reinsurance agreement. For example, JPMorgan Chase has made approximately $600 million since 2006 by taking 75 percent of the profits from the force-placed business it gave Assurant.

One measure of how profitable force-placed insurance has been for Assurant is how little it has paid in claims—what is known as the loss ratio. In its 1994 rate filing with DFS, one of Assurant’s subsidiaries based its rate on the expectation that it would pay 58 percent of premium on claims. In fact, from 2006 through 2011, that subsidiary actually paid only 24.7 percent, 19.4 percent, 17.3 percent, 22.8 percent, 24.3 percent, and 24.7 percent, respectively. Despite years when it paid out claims less than half of what it projected, Assurant did not file for lower rates. For voluntary homeowners insurance the loss ratio has historically been around 63 percent nationally.

Key Terms of the Settlement

The settlement that Assurant and the New York State Department of Financial Services signed today includes restitution for homeowners who were harmed, a $14 million penalty, and a set of major reforms for force-placed insurance at Assurant.

Superintendent Lawsky said: “By agreeing to implement these critical reforms, Assurant is serving as an industry leader. These reforms will make Assurant a stronger and better company focused on its customers. Other force-placed insurers, including QBE, need to step up to the plate now and put in place these reforms. Our work on this issue is far from done and we expect that this settlement will help lead a nationwide reform effort for this industry.”

The key terms of the settlement include:

To lower the cost of force-placed insurance going forward for all non-flood business:

- Assurant shall file with DFS a premium rate with a permissible loss ratio of 62 percent, supported by the required data and actuarial analysis that is acceptable both professionally and to DFS. This will substantially reduce homeowners’ premiums.

- Every three years, Assurant will be required to re-file its rates with DFS for review.

- If Assurant’s actual rates in any year result in an actual loss ratio of less than 40 percent for the immediately preceding calendar year, Assurant will be required to re-file its rates for the next year for DFS review in order to bring the loss ratio back up.

- Assurant must report annually to DFS on its actual loss ratio, earned premiums, itemized expenses, losses, and reserves.

To put a stop to the improper practices found in DFS’s investigation, many of which helped Assurant support inflated premiums:

- Assurant shall not issue force-placed insurance on mortgaged property serviced by a bank or servicer affiliated with Assurant.

- Assurant shall not pay commissions to a bank or servicer or a person or entity affiliated with a bank or servicer on force-placed insurance policies obtained by the servicer.

- Assurant shall not reinsure force-placed insurance policies with a person or entity affiliated with the banks or servicer that obtained the policies.

- Assurant shall not pay contingent commissions based on underwriting profitability or loss ratios.

- Assurant shall not provide free or below-cost, outsourced to banks orservices to servicers or their affiliates.

- Assurant shall not make any payments, including but not limited to the payment of expenses, to servicers, lenders, or their affiliates in connection with securing business.

To provide restitution to those who were harmed by Assurant’s practices:

- Refunds will be provided to consumers through a claims process and a third-party administrator selected by DFS and paid for by Assurant for homeowners who have been force-placed at any time after January 1, 2008 and meet the eligibility criteria for one of the following three categories of claimants:

- Homeowners who defaulted on their mortgage or were foreclosed because of force placement.

- Homeowners who were charged for force placement at a coverage limit higher than permitted by their mortgage.

- Homeowner’s who were erroneously charged for force-placed insurance: either because they had voluntary insurance in effect, or they were charged commercial rates for a residence.

Additionally, under the terms of the settlement, Assurant will pay a civil penalty of $14 million to the State of New York; provide improved disclosures and notices to homeowners; improve its email retention policy; and ensure that the amount of coverage force placed on any homeowner shall not exceed the last known amount of coverage, provided that if the last known amount of coverage did not comply with the mortgage, then the amount of coverage shall not exceed the replacement cost of improvements on the property.

To read a full copy of the Department of Financial Services’ settlement with Assurant, please visit, link.

###

SOURCE: http://dfs.ny.gov

~

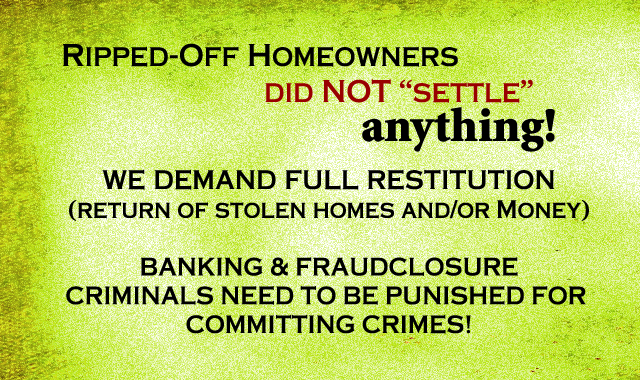

My husband and I fought the bank (a long arduous six year battle), when we discovered that our signatures had been forged on the mortgage of our home, notarized and recorded. After six years of being beaten, bitten, battled and bruised, we won in the 6th US Circuit Court in January of 2004. (Sutter vs US Bank)

You would have thought that it was over…but not by a long shot. I spent the first half of 2012, looking for, and finding a reputable law firm to handle Act II of this never-ending story of victimization on it’s highest white collar level.

Even though the bank doesn’t have a valid lien on our property (the mortgage was avoided in 2007), they still act as if there is one. The jump us on paying the taxes on our home (realistically, my husband and I pay close to the due date, because that’s what we can afford to do; and the bank makes sure that they pay before the end of the year, in order to get the tax break (and taking the tax break away from us, making sure the we, as self-employed people, are made to suffer more.

Throughout this whole debacle, our home that we have fought so valiantly for, has been slowly but surely deteriorating. Here is the kick…the “mortgage” company feels that they have had the right to insure our home for the past six years (even at times when we already had homeowners)…so even though they have absolutely no interest in our home they have an insurance policy on our home with their names as Named Insured. Even though they have no mortgage (just a note (we will get into that in a moment)); if my home were to burn down tomorrow, they would get paid and we would be homeless (their goal from the get-go on this).

Well, last Thursdays, I set fear aside and filed a claim on that insurance. We are on the policy as Other Insured and, due to the banks actions, we have not been able to fix our home, which has caused some extensive damage to our roof and knee wall on the second floor (we won’t even discuss the garage where the roof collapsed on it last Fall). When I told the mortgage adjuster they didn’t have a mortgage, but they had a note, he couldn’t understand how (join the club). So this should prove to be interesting. There is a valid policy; the court system, bank and our attorneys hindered us from ever contacting the insurance company (don’t fix the house, it may not be yours). We didn’t even know that we were able to file a claim; after all, the policy was not purchased by us (even though it has gone on our ever-growing bill with said company, every year, along with the tax payments).

Let’s put this all into focus.

1. The bank, when they lost the mortgage in 2007, most likely filed a claim with the title insurance and was paid for the note on our home (this is being investigated)…we will call this Pay Day 1

2. The bank, should something catastrophic happen to our home, would get paid for the property and we, should we survive, would be out on the streets with nothing…Pay Day 2

3. The bank, as we get further into our current litigation are going to want their “Note” paid from the judgment…Pay Day 3

Let’s delve a little deeper:

1. With them as named insured on this insurance policy odds are good that they are going to try to get their name on that insurance check (because isn’t that protocol that the Named Insured is on the proceeds) which would mean that they could take the proceeds from the insurance check, intended to fix the house and apply it to the “arrearages”…Pay Day 4?

Let’s delve into the taxes

1. For the past six years, the bank has repeatedly beat us to the punch on paying our property taxes. Each of those years they have had the tax advantage of taking that deduction away from us at tax times, hurting us by costing us money in taxes we wouldn’t have had to pay had we made the tax payment. Now that we are going for the judgments against them, they are going to want to have their tax money paid. Now we pay those taxes and we have to go back and redo our taxes? Do they redo their taxes? Or do we just eat it?…Pay Day 5?

Here is the reality that I personally see. In six years, we proved that the bank was at fault for a forgery…considered a crime in the real world. The fact that they can insure my property when they have no legal interest is outrageous…the fact that they can lie to the insurance company (as demonstrated by the language in all correspondence from the insurance company where my husband and I are listed as “Mortgagees” and the servicing company as “Mortgagor”. In my mind, this is Insurance Fraud on the part of the bank…isn’t that a crime too?

I feel like I am in this never-ending tempest of lies, deceit and fraud…it will be interesting to see how this insurance issue plays out.