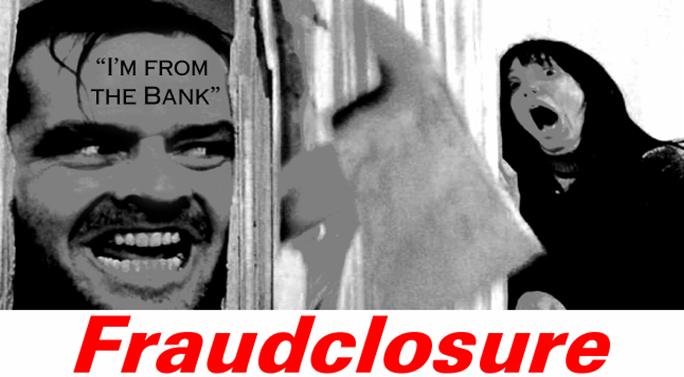

‘Property Preservation’ Mortgage Documents Give Unlawful Power to Lenders

Imagine this: You’ve missed two mortgage payments. You come home from work and realize someone changed the locks on your front door and installed a lockbox on the doorknob.

Think this could never happen to you? Think again. It happens all across the country, and it could happen in Texas.

A common provision in mortgage loan documents, generally known as a “property preservation” clause, gives lenders the right to lock homeowners out of their own homes if the homeowner misses mortgage payments and is in default, or if the lender concludes that the borrower has abandoned a house.

The Supreme Court of the state of Washington examined one of these clauses in a recent case.

The court concluded that these clauses are unenforceable because, contrary to state law, they let lenders take possession of a borrower’s home before a foreclosure sale.

Rest here…

~

No Comment