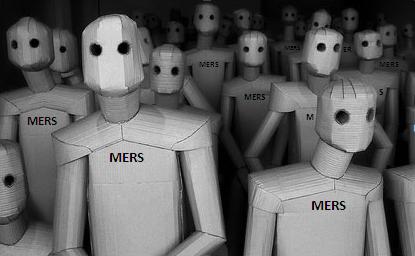

Requiem for MERS (and the Banks That Created the Frankenstein Monster)

It is now widely recognized that MERS facilitated fraud by lenders, servicers, foreclosers and securitizers. Even on the most charitable interpretation it is very difficult to believe that MERS was not fraudulent by design. So much of the story has already been told that we do not need to rehash all of it here. Let me first concisely summarize the two main problems, and then move on to the most recent developments that put the final nails in MERS’s coffin. I’ll conclude with my argument that there really was some “not so intelligent” design behind all of this. But it is coming back to bite the hand that feeds. The big banks will not survive the monster they created.

Whenever those who are critical of MERS and the banksters post blogs about the multiple frauds, we are attacked by commentators — presumably industry hacks — who try to obfuscate the issues. But recent court cases as well as testimonies before elected representatives confirm our two main claims. First, many or most foreclosures that are taking place are illegal because those doing the foreclosing do not have legal standing. And, second, the practices that created the foreclosure problems also mean that the mortgage backed securities are actually unsecured debt. That means banks must take them back, so they are toast. It all comes back to MERS’s business model: it destroyed the chain of title.

Much of the rest of the fraud and scandal we are witnessing follows on from that because the banks want to foreclose the properties before the securities holders put back the fraudulent securities. The problem is that the destruction of the clear chain of title makes it impossible to foreclose, so the banks used robo-signers to forge documents in the hope they could paper over their home thefts. But homeowners, courts, legislators, securities investors, and title insurers have caught on to the scam. In addition to the forgeries, MERS and bank officials and lawyers are committing perjury in court in the hope that they can confuse the issues sufficiently that they can complete the home thefts.

However, improper foreclosures produce houses that cannot be sold legally — so the can is just kicked down the road to the next crisis, which will reveal that those who have purchased foreclosed homes have no legal title to them. And so their debts will also be unsecured. MERS has created a disaster that will not be resolved for at least a decade, perhaps a generation. Given the scale of foreclosures (projected at 13 million by 2012), future home purchasers face a pretty good chance that if they are buying pre-owned housing, their title to the property is dubious.

Let us quickly review recent developments.

Continue reading here…

~

Two brand new cases in Nevada find nonjudicial foreclosure execution defective:

http://bryllaw.blogspot.com/2011/01/nevada-another-non-judicial-state-where.html