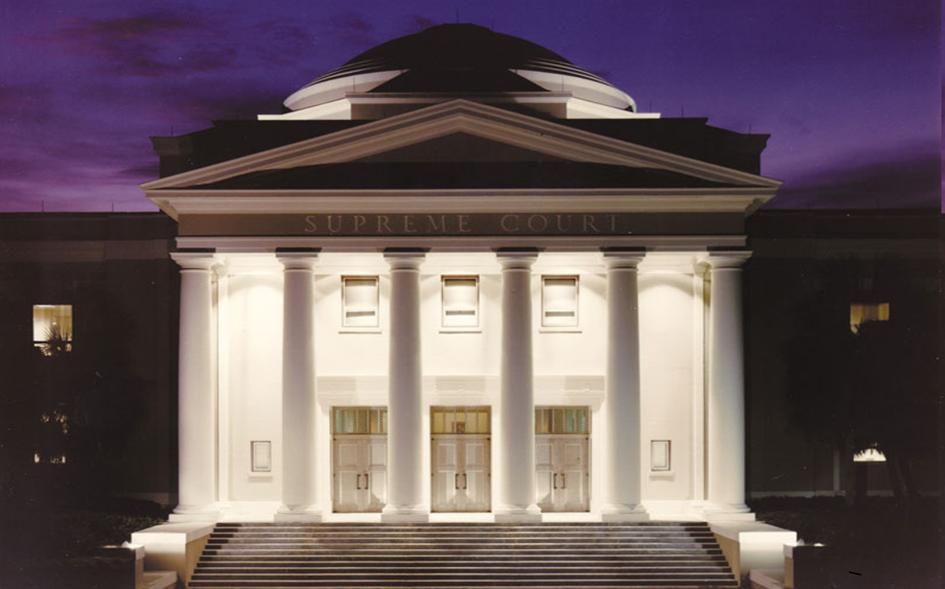

Case involving alleged foreclosure fraud headed to Florida Supreme Court

A South Florida homeowner who is fighting a mortgage foreclosure could end up reshaping state law.

An appeals court on Wednesday asked the Florida Supreme Court to consider Roman Pino’s case as a matter of “great public importance,” a move legal experts say could result in reforms in foreclosure cases where there is evidence of fraud in the way documents were handled by lenders, mortgage servicers and law firms.

The decision by the 4th District Court of Appeal in West Palm Beach to send the case to the state Supreme Court was unusual, because neither the homeowner nor the bank seeking to foreclose on Pino’s home had asked for such a review.

“We conclude that this is a question of great public importance, as many, many mortgage foreclosures appear tainted with suspect documents,” the appeals court wrote.

If the case is taken up by the Supreme Court and results in a decision in favor of the homeowner, legal experts who specialize in foreclosure law say the case has the potential to affect thousands of foreclosures across the state where there are allegations of document fraud.

“There is this huge problem that is evident across the state. The District Court of Appeal is handing this up to the Supreme Court because of the importance of this bigger problem,” said South Florida attorney Margery Golant, who works with The Florida Bar to educate attorneys about proper document handling in foreclosure cases.

You can check out the rest of the report here…

From THETR

Although the 12-member appeals court, in a 9-1 ruling (with one recusal and one retirement subsequent to the hearing and prior to the issuance of the ruling) affirmed a lower court ruling in favor of the foreclosure mill, it obviously felt that it should be the state Supreme Court that should take a look at this issue and make the ultimate decision as to how to proceed when dealing with the dubious practices engaged in by foreclosure mills. In this regard, the court observed:

We conclude that this is a question of great public importance, as many, many mortgage foreclosures appear tainted with suspect documents. The defendant has requested a denial of the equitable right to foreclose the mortgage at all. If this is an available remedy as a sanction after a voluntary dismissal, it may dramatically affect the mortgage foreclosure crisis in this State.

In support of the homeowner’s position in this case, the following excerpt gives a taste of the vigorous, six-page dissent originally authored by the since-retired Judge Farmer (concurred with and formally filed by Judge Mark E. Polen) (bold text is my emphasis):

This issue is one of unusual prominence and importance. Recently, the Supreme Court promulgated changes to a rule of procedure made necessary by the current wave of mortgage foreclosure litigation. See In re Amendments to Rules of Civil Procedure, 44 So. 3d 555 (Fla. 2010). In approving one amendment, the court pointedly explained:

“[R]ule 1.110(b) is amended to require verification of mortgage foreclosure complaints involving residential real property. The primary purposes of this amendment are (1) to provide incentive for the plaintiff to appropriately investigate and verify its ownership of the note or right to enforce the note and ensure that the allegations in the complaint are accurate; (2) to conserve judicial resources that are currently being wasted on inappropriately pleaded ‘lost note’ counts and inconsistent allegations; (3) to prevent the wasting of judicial resources and harm to defendants resulting from suits brought by plaintiffs not entitled to enforce the note; and (4) to give trial courts greater authority to sanction plaintiffs who make false allegations.” [e.s.]

44 So. 3d at 556. I think this rule change adds significant authority for the court system to take appropriate action when there has been, as here, a colorable showing of false or fraudulent evidence. We read this rule change as an important refutation of BNY Mellon’s lack of jurisdiction argument to avoid dealing with the issue founded on inapt procedural arcana.

Decision-making in our courts depends on genuine, reliable evidence. The system cannot tolerate even an attempted use of fraudulent documents and false evidence in our courts. The judicial branch long ago recognized its responsibility to deal with, and punish, the attempted use of false and fraudulent evidence. When such an attempt has been colorably raised by a party, courts must be most vigilant to address the issue and pursue it to a resolution.

Oral arguments can be viewed here…

Full opinion and transcript of oral arguments below…

~

4closureFraud.org

~

FL 4th DCA Pino v. The Bank of New York Mellon Opinion

FL 4th DCA Pino v. The Bank of New York Mellon Oral Arguments Transcript

I just telephoned Florida AG Pam Bondi-spoke with Maggie and left a message.

They ask for your Name & Phone Number

PLEASE CALL FLORIDA AG’s TOLL FREE NUMBER 866-966-7226