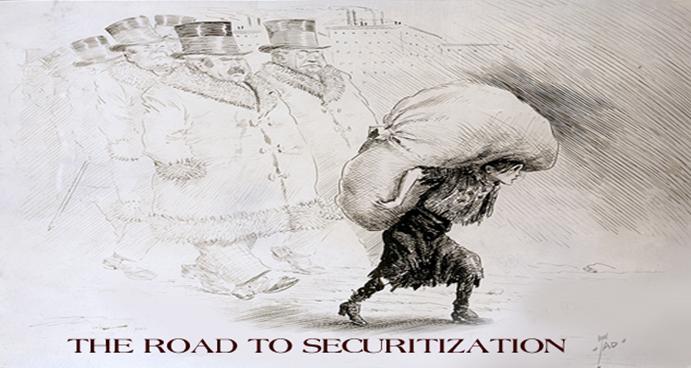

DECONSTRUCTING THE BLACK MAGIC OF SECURITIZED TRUSTS:

HOW THE MORTGAGE-BACKED SECURITIZATION PROCESS IS HURTING THE BANKING INDUSTRY’S ABILITY TO FORECLOSE AND PROVING THE BEST OFFENSE FOR A FORECLOSURE DEFENSE

INTRODUCTION

From 2003 to 2007, Florida saw the largest real estate boom in its history. Real estate sold at astonishing prices as people were sold a bill of goods known as the “American Dream.” But for many, that American Dream turned out to be the American Nightmare. From sub-prime mortgage lending and predatory practices by mortgage brokers, lenders and improper securitization of mortgages, this era of economic boom led to the largest crash in the history of the real estate market2, a crash from which Florida has yet to recover, and to which we have not yet seen the end. The full extent of the damage inflicted by these practices has not yet been felt, but millions of homeowners nationwide have suffered from financial crisis, foreclosure and bankruptcy. And what is worse yet is that the systemic fraud and illegal conduct of the banks has continued to pervasively infect court systems throughout the nation; further, the Florida court system has suffered from extreme abuse at the hands of the banks that have high jacked it and effectively turned it into a private collection agency for the banking industry.

Full paper below…

~

4closureFraud.org

~

DECONSTRUCTING THE BLACK MAGIC OF SECURITIZED TRUSTS

I VENT… Bush Sr. and Cheney have been together for many many years…it goes way back…2 criminals like peas in a pod….crooks from way back…so this is the 2 main characters in this whole set up….read the history on them…..they have been intertwined in the government for many years…even before JFK was murdered………

I vent… Clinton is just as bad as the Bushes….he was just more sly at what he was up to….slimbags all of them…living the high good life when ALL should be behind steel bars…till a decision is made what to do with each one of them… treason and traitors……AND now Clintons daughter is considering running for CONGRESS….LOL….more contaminated blood….WHOA NELLY…. i WOULD SAY WE HAVE HAD ENOUGH OF THE CLINTON’S…..

Well their all related Marilyn by bloodline….inbreds……that is probably why they are all so diabolical…I read a long time ago that Clintons real father is old man Kennedy…..I don’t know what Hillary’s excuse is for being soo evil…she is probably an Occultist….most of them are…into that old black magic….human sacrifice and all of that sick shit…I read at a website that all of the victims of 9/11 were a part of some sick human sacrifice by these occultists..I read that biblical scholars have pinpointed the real date of Jesus birth as 9/11.I read along time ago and this was written by a Catholic Theologian, that they hold Black Masses at the Vatican…..I don’t know Marilyn, the more you look, the more evil it gets…Almost too evil to even want to think about…!

Like my Irish Catholic Grandma used to say, it is enough to make your hair curl!!!

I vent….Everytime I would read about that damn bloodline as if it was so special and great…all I could think was… no wonder they are all wired wrong….their brain is twisted….I see it as contaminated blood….AND if it all is true that they all are blood related….there must have been an awful lot of hankie pankie going on at their satanic gatherings…..in that video of the Skulls and Bones..there was alot of screaming around the fire…..now we know why.

I remember being told that Jesus was not born on christmas but in the fall time…but his birth was celebrated months later when the 3 kings arrived. from the journey from afar… ….whatever……they say the real truth written in history of the bible has been translated so many times in different languages that the real truth has been destorted……all I know is what is going on now must be the sickest of the sicko’s…..

It is true Marilyn, Fox News did a segment on it..it is on you tube…They are evil…like that Bohemian Grove crap..Looks like it is all true, a Satanic Cult is running the world..it is the hierarchy though…but the evil is all throughout everything….I did learn alot from my Catholic upbringing though, it prepared me for many things in my life…..There is good and bad in everything….and God works in mysterious ways…How dare Satan enter God’s sanctuary..? This evil plan started with Vatican Council II, on October 11, 1962……though there were many anti-popes through out Church history…Those damned Jesuits!

Great article. Share the knowledge and bring legal actions against the banks. Upsidedown or in foreclosure…let’s sue these SOB’s!

Visit us at our site for free empowering information.

Have you seen the Get Money Out campaign by Dilan Ratigan? Money is the real problem.

Yeah we saw it..first we have to get the traitors out.

…how about we disembowel the bansters……

Rob, first we must address the politicians who made this all possible…..!! With out Clinton it could not have happened! Then we have that traitor rat Bush..who the FBI warned the Bush administration in 2004 this was happening and there was still time to fix it…Bush did nothing….Proof this was a NWO Hitler Plan!

W. is…….. and was……..not that smart……..I blame his Daddy….. the real live Nazi…..George H.W. bush!

He could be the main culprit Rob….

Vent…..I seriously believe it is so!

Uh oh Rob….Obamas coming to Chicago today to visit his buddy, the Rahmfather….Tom Dart shouldn’t let the traitor in….Obama is a NWO Globalist fascist pig…He said the EU laid important ground work for the banks financial crisis..I say who gives a f__k? Europe SHOULD NOT be our problem…dirty traitors, all of them! As for old man Bush Rob…I believe he is the biggest traitor alive in this country right now next to his son….even worse than Clinton….Notice Clinton is the U.N. Ambasador now, the so called president of the world they call him…and Hillary is the Secretary of State…the pay off for all of the NWO bullshit he passed when he was in office…like NAFTA and so on…Fascist Globalist NWO pigs all of them..liars, deceivers.theives and hoarders…!

You left somethig out Vent……..bad guys.

Yes, bad guys for sure Rob!

I vent…Rob is right….the real villian is the old man himself…he was behind the other prompting him all the way……in fact..the old man was always in pictures with Bush from campaign on…till Bush started the fake war in Iraq….and daddy started to stay in back ground…and has stayed out of the scene since….he has always been a greedy slimbag…wanting everyones oil…and he is the true nazi in that family……