Payday lenders use courts to create modern debtors’ prison

Wakita Shaw’s troubles started with a $425 payday loan, the kind of high-interest, short-term debt that seldom ends well for the borrower.

But most of them don’t end up in jail. So Shaw was surprised in May of last year to hear that the St. Louis County police were looking for her. She and her mother went to the police station.

They arrested her on the spot.

They told her the bail was $1,250. “And I couldn’t use a bail bondsman to get out,” Shaw recalled.

The Bill of Rights in the Missouri constitution declares that “no person shall be imprisoned for debt, except for nonpayment of fines and penalties imposed by law.” Still, people do go to jail over private debt. It’s a regular occurrence in metro St. Louis, on both sides of the Mississippi River.

Here’s how it happens: A creditor gets a civil judgment against the debtor. Then the creditor’s lawyer calls the debtor to an “examination” in civil court, where they are asked about bank accounts and other assets the creditor might seize.

If the debtor doesn’t show, the creditor asks the court for a “body attachment.” That’s an order to arrest the debtor and hold him or her until a court hearing, or until the debtor posts bond.

Rest here…

~

Slime ball tactics- this is just not right- its Un-American! They’ve really got it backwards now! America, land of the free? Home of the slave- this can’t be happening in this country- it needs to stop before it begins-

What’s the next step? Extermination of debtor’s?

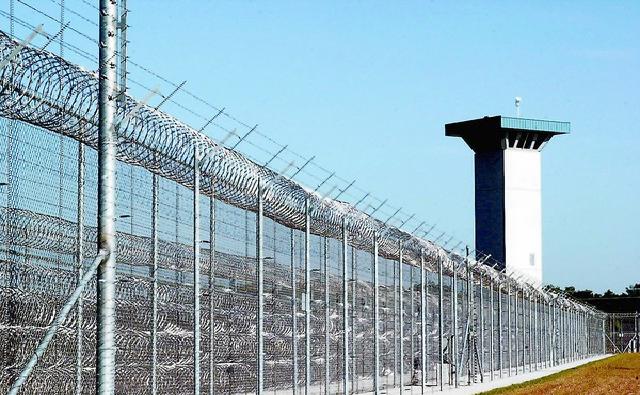

conflict of interest… money from many sides and filling and using the newly privately owned jails “for profit” most likely in the corruption mix also, every evil entity scratching the other evil entity, too many tentacles to count…yep fishy and stinks, yes modern day mafia in warp speed!!! VILE!!!

Everything is the opposite of what it should be.

Wow this should not be allowed to happen.Unsecured debt.Our police are bought and paid for by whoever has the most money to do so.Is this really what our great nation has come to?Pathetic and perverse.