Your New Landlord Works on Wall Street

Hedge funds are snatching up rental homes at an alarming rate

Housing analysts have been giddy for the past year about the comeback of their industry, whose collapse led to the Great Recession. Sure, 2012 was actually the third-worst year for housing ever—but it still beat 2010 and 2011. New and existing home sales, housing starts, and prices jumped in 2012, and experts expect an even stronger recovery for 2013.

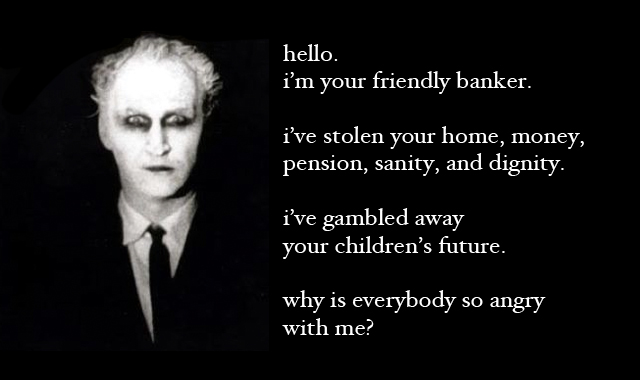

It’s clear why people are so excited: Housing typically leads economic recoveries. As more people build equity in their homes, they feel more free to spend disposable income and increase economic activity, a phenomenon known as the “wealth effect.” So a bullish outlook for housing would seemingly augur a long-awaited recovery to Main Street. But the more you look into it, the clearer it becomes that it’s not being driven by the typical American families who lost their homes in the economic crash. In fact, it’s being fueled by the banks and hedge funds whose speculation caused that crash in the first place.

If you’ve signed a lease in the past year, there’s a good chance your landlord wears a tailored suit and works on Wall Street. One of the hottest trends in the financial sector is known as “REO-to-rental.” Over the past couple years, hedge funds, private equity firms and the biggest banks have raised massive amounts of capital to buy distressed or foreclosed single-family homes, often in bulk, at bargain prices. Their strategy is to convert them to rental units for a while before reselling them when prices appreciate. The Wall Street firms are scooping up properties in the hardest-hit areas, promising high returns for the rental revenue streams—up to 10 percent annually —and starting bidding wars that have driven up some prices well above national averages. It’s the next Wall Street gold rush, with all the warning signs of a renewed speculative bubble.

Rest here…

~

After my fraudclosure, life in Florida was wonderful compared to

being back in New york, having to Rent in two REITS simply because for extra money you can bring your dog.

REITS as nice as some might look are run by slumlord type managment at high rents.