Talking Points

See the links below for some examples from the last 60 DAYS of the fraudulent activities that are being perpetrated every day…

There is much more if you research this blog. Enjoy…

Another WSJ Smackdown! Florida Judges Bash Banks in Foreclosure Cases

“I don’t have any confidence that any of the documents the Court’s receiving on these mass foreclosures are valid,” the judge said at the hearing…

OVERRULED!!! Florida Judge Reverses His own Summary Judgment Order!

“There was a different plaintiff pursuing a foreclosure proceeding on the same note and mortgage as the one that was being proceeded on. Both of the cases contained allegations in the original complaints that the separate plaintiffs were owners and holders of the note. Both of them had gone so far to have affidavits filed in support of a summary judgment whereby an individual represented to the court in the affidavit that the separate plaintiffs had possessed the note and had lost the note while it was in their possession.”

Mortgage Assignment Fraud – David Sterns Office Commits Fraud on The Court – Case Dismissed WITH Prejudice

“the Assignment of Mortgage was created after the filing of this action, but the document date and notarial date were purposely backdated by the Plaintiff”

The Assignment, as an instrument of fraud in this Court… was made to appear as though it was created and notorized on December 5, 2007. However, that purported creation/notarization date was facially impossible:

the notary stamp used on this instrument did not even exist until approximately five months after the purported date on the Assignment.

Wells Fargo Motion for Judgment of Foreclosure and Sale for the Premises is DENIED WITH PREJUDICE Complaint is Dismissed

“Plaintiff’s counsel never notified the Court that the mortgage had been satisfied and failed to discontinue the instant action with prejudice.”

“Plaintiff’s counsel, Peter G. Zavatsky, Esq., and his firm, Zavatsky, Mendelsohn & Levy, LLP, will be given an opportunity to be heard as to why this Court should not sanction them for making a “frivolous motion,”

Foreclosure Mill Attorney for Marshall Watson or Foreclosure Defense Attorney for Homeowners?

Defendants move to disqualify JOHN A. WATSON from continuing to appear in this case as their counsel and for the disgorgement of the $1,000 paid to WATSON in attorney’s fees on the following grounds…

JOHN WATSON Has A Conflict of Interest in that He—Through the Firm With Which He is Associated—Represents the Plaintiff, AURORA LOAN SERVICES LLC in Other Cases…

he actually appears in court on behalf of the Plaintiff in this case, AURORA LOAN SERVICES LLC…

The “relative” to whom JOHN WATSON referred is his brother, Marshall C. Watson, the principal of the Law Offices of Marshall C. Watson, P.A. (the “MARSHALL WATSON FIRM”), a law firm “which strictly represents mortgage lenders and servicers throughout Florida”…

Bank of America Forecloses, Auctions Home with Paid-Up Mortgage

On Tuesday, my husband was working on his truck. A guy came over to him, I think, and shook his hand and said, ‘Hi, I just bought this house.’ [My husband was] thinking to himself, ‘Yeah right, you’re joking,”

“He had the paperwork in his hand and I said, ‘Oh my gosh!’ So sat down, got Bank of America on the phone right away, verified, not delinquent, but didn’t say there was a mistake,” recalled Achaibar.

The Achaibars’ Bank of America mortgage statement showed their monthly payments had been paid on time.

“They sold my house overnight and they need to fix this fast,”

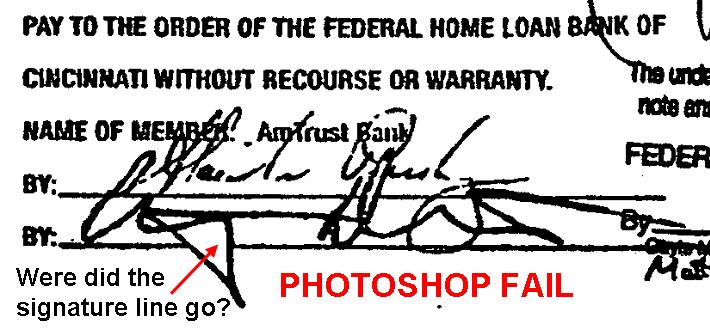

Foreclosure Fraud of the Week – Poor Photoshop Skills

SHOCKING REVELATION! J.P. Morgan Chase / LPS Produced a Fraudulent Assignment of Mortgage!

Chase has filed documents that appear to be either patently false or misleading

an assignment showed that Chase held the Mortgage and was assigning that Mortgage to Deutsche. Not only was the assignment dated post-petition, but it was signed only a few days before Chase filed the Motion For Stay Relief.

This is not the first time that Chase’s conduct with regard to motions for relief from the stay has been questioned in a bankruptcy case..

WSJ Picks Up on Bogus – U.S. Probes Foreclosure-Data Provider Lender Processing Services Docx

The prosecutors are “reviewing the business processes” of the subsidiary of Lender Processing Services Inc., based in Jacksonville, Fla., according to the company’s annual securities filing released in February. People familiar with the matter say the probe is criminal in nature.

WSJ – U.S. Probes Foreclosure-Data Provider

Lender Processing Services Unit Draws Inquiry Over the Steps That Led to Faulty Bank Paperwork

Scandalous – Substantiated Allegations of Foreclosure Fraud That Implicates the Florida Attorney General’s Office and The Florida Default Law Group

The notary who allegedly administered the expert’s oath and vouched for her signature was Erin Cullaro, a former employee of FDLG and now an Assistant Attorney General in the Economic Crimes Division of the Office of the Attorney General.

Defendants proffer that they will show affidavits executed on days other than those approved by the Office of the Attorney General and that travel records suggest that Ms. Cullaro would have not been present in Florida on the date and time that an affidavit was notarized.

Here are the signatures to compare…

Verification of Mortgage Foreclosure Complaints

many firms file lost note counts… because the physical document was deliberately eliminated

Mortgage foreclosure cases are unique in that the holders of the notes are often unfamiliar with the status of the loans

while the holder of the note may verify that it is the holder of the note, it may not have personal knowledge when the last payment on the note was made or if a default notice was mailed to the client

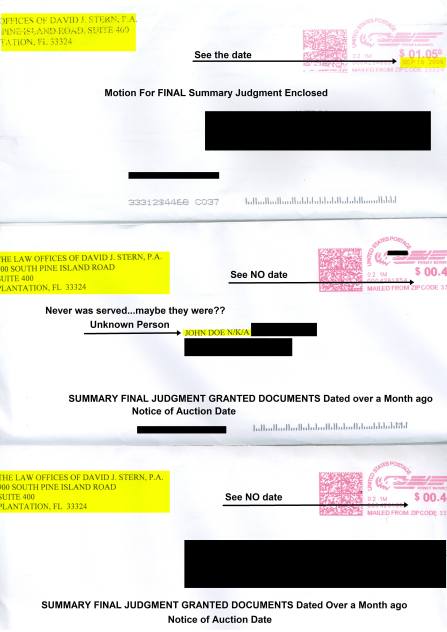

FORECLOSURE MILL ENVELOPES OF SERVICE w/o Postage Dates

wrongly repossessed her home, padlocked the doors, shut off the utilities, damaged the furniture and confiscated a pet parrot, though her mortgage payments were on time.

Lender Processing Services, Inc. – FORM 10-K – EX-21.1 – February 23, 2010 Legal Proceedings

The complaint essentially alleges that the “industry practice” of creating assignments of mortgages after the actual date on which a loan was transferred from one beneficial owner to another is unlawful. The complaint also challenges the authority of individuals employed by our document solutions subsidiary to execute such assignments as officers of various banks and mortgage companies…

Recently, during an internal review of the business processes used by our document solutions subsidiary, we identified a business process that caused an error in the notarization of certain documents, some of which were used in foreclosure proceedings in various jurisdictions around the country…

Most recently, we have learned that the U.S. Attorney’s office for the Middle District of Florida is reviewing the business processes of this subsidiary. We have expressed our willingness to fully cooperate with the U.S. Attorney.

No Comment